Financial Insecurity in America Soar to Record High – Survey

Share

Financial insecurity among Americans has hit a ten-year peak, according to Northwestern Mutual’s 2024 Planning & Progress survey. One-third of American adults expressed feeling financially insecure, up from 27% in 2023, marking the highest level since 2012.

Christian Mitchell, the company’s chief customer officer, attributes this trend to the persistent financial disruptions Americans have faced in recent years. The high cost of living remains a significant contributor to financial anxiety, with over half of respondents anticipating increased price pressures.

“People are recognizing that building wealth isn’t enough; they want to protect what they’ve already created, too,” Mitchell said.

“This year, more Americans say they want to play better defense so the surprises that arise aren’t so disruptive to their financial lives.

“There are still great opportunities to save and invest in this environment, so Americans shouldn’t feel limited by a choice between protection and prosperity – they can and should choose both.”

Additionally, only 9% reported that their household income outpaced inflation. While the overall inflation rate has slowed down, many Americans have not experienced relief in their budgets.

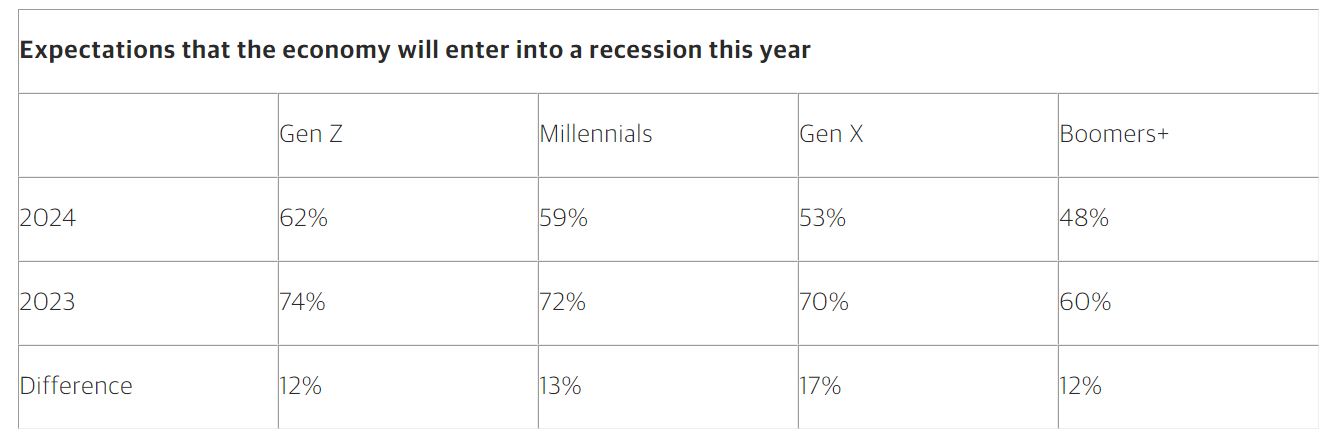

However, Costco’s recent announcement of reducing prices on certain items brought a rare moment of positivity. Despite concerns about the broader economy, the survey revealed a slight decrease in the number of respondents predicting a recession compared to the previous year.

Government dysfunction, the presidential election, and potential recessions were among the top concerns for respondents.

Financial Anticipations regarding the economy

Regarding financial planning, the survey found a decline in the percentage of Americans considering themselves disciplined financial planners. While many express intentions to save more and cut costs, a significant portion still expects to maintain or increase spending on non-essential items like dining out and vacations.

Interestingly, Gen Z emerged as the generation most likely to increase discretionary spending, raising concerns about financial stability amidst economic uncertainties. Mitchell emphasizes the importance of prioritizing planning and discipline, especially during uncertain times.

“My main concern is those with Yolo dreams colliding into a recession reality,” said Northwestern Mutual’s Mitchell.

“At a time when people are feeling unstable about their financial futures, we’re encouraging our clients to prioritize planning and discipline like it was 2020 again.”

The survey, conducted online by the Harris Poll, gathered responses from 4,588 US adults between January 3 and 17.