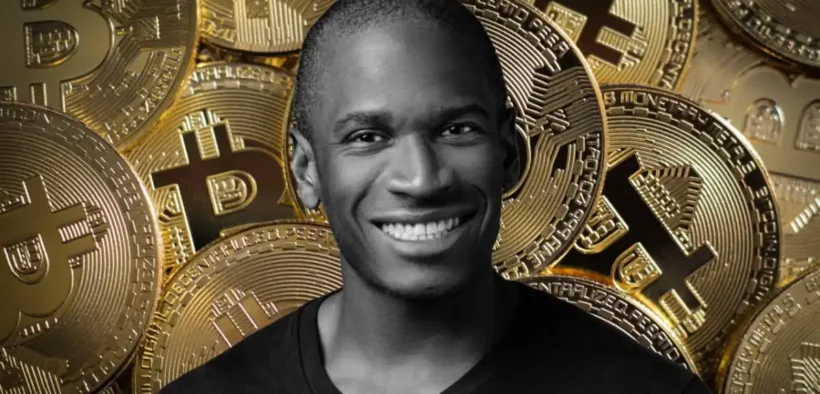

Arthur Hayes Eyes $250M for Crypto Buyout Fund

Share

Arthur Hayes remains upbeat on Bitcoin even after the latest drawdown, and he’s putting money behind that conviction. His family office, Maelstrom, is raising a $250 million private-equity fund to acquire four to six mid-sized crypto companies, targeting trading infrastructure, analytics platforms, and other “non-token” equity plays.

Planned deal sizes range from $40 million to $75 million per acquisition.

The fund is slated to be U.S.-registered, with a first close targeted by March 2026 and a final close by September 2026, according to interviews and materials cited in multiple outlets. Hayes and partners Akshat Vaidya and Adam Schlegel are leading the effort.

Hayes has argued the industry is moving beyond its four-year boom-bust rhythm, helped by policy tailwinds and macro stress in banking. In contrast, long-time Bitcoin critic Peter Schiff recently warned on X that a “brutal” bear market is coming, noting BTC’s slide versus gold since August.

Hayes’ high-profile return to deal-making follows a March 2025 presidential pardon related to the BitMEX case, in which founders pleaded guilty in 2022 to failing to implement an anti-money-laundering program.

For Black investors—an audience where Hayes has significant influence—the stakes are meaningful. Research from the Federal Reserve Bank of Kansas City finds Black consumers are more likely than white consumers to own cryptocurrency, often at the expense of stock and mutual fund ownership—exposure that can amplify volatility risks.

Vaidya says Maelstrom’s strategy deliberately avoids token-driven valuations in favor of cash-flowing businesses—aiming to sidestep the hype cycles that have burned many retail holders.