Bitcoin Eyes $112K Milestone as Analysts Spotlight Three Key Metrics

Share

Bitcoin is once again at the center of market speculation, and analysts are honing in on three crucial metrics that could determine whether the digital asset breaks into record territory.

According to experts, the Market Value to Realized Value (MVRV) ratio, on-chain activity, and trading volumes are flashing signals—though with one important caveat: momentum must return.

MVRV Shows Maturing Cycle, Yet Room to Grow

The MVRV ratio, a key indicator comparing Bitcoin’s market value to the cost basis of holders, is beginning to lose steam. Historically, such behavior hints that the market may be entering a late-stage bullish phase.

However, analysts stress that the ratio remains well below levels associated with overheated valuations—leaving the door open for continued gains.

Trading Volumes and Transfer Activity Dip Sharply

A more immediate concern lies in Bitcoin’s network activity. Data shows that on-chain transfer volume has dropped 32% in recent weeks—from $76 billion to $52 billion.

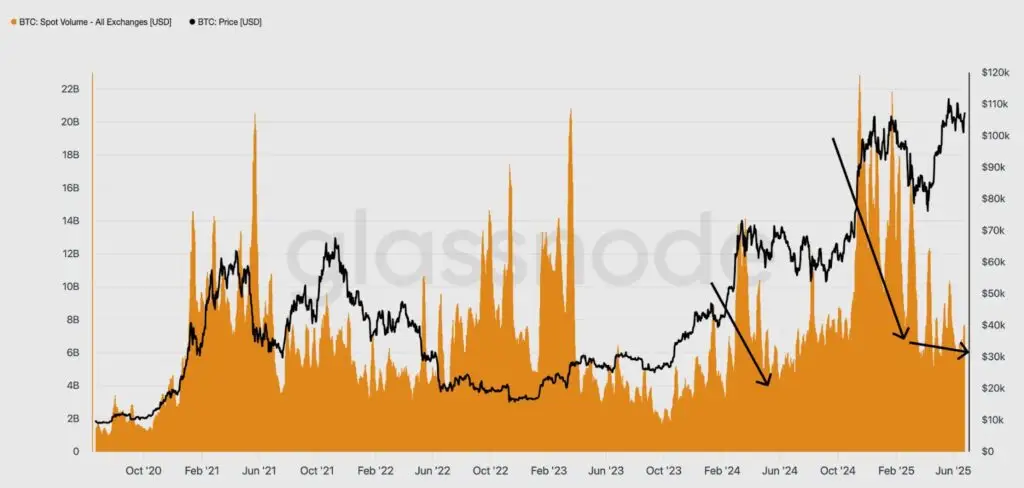

Spot trading volumes have also thinned to $7.7 billion, a notable decline from previous bullish peaks. This dip in engagement reflects waning speculative enthusiasm and suggests the market is catching its breath.

With Bitcoin currently fluctuating between $100,000 and $110,000, some analysts see this as a consolidation phase. A decisive breakout above $110,000 would signal renewed strength, but bulls may need to defend lower levels around $104,000–$105,000 before staging a fresh rally.

Rally Conditions: Clear, But Demanding

To fuel a surge past the elusive $112,000 mark, analysts are watching for three conditions:

- A renewed uptick in MVRV momentum

- A strong recovery in on-chain transfer volume

- Increased spot trading volume reflecting stronger conviction

Analysts agree: the next leg up hinges not just on charts, but on behavior. If confidence returns and volumes rebound, Bitcoin could be poised to chart new highs—and with it, a new chapter for digital assets.